Step-by-Step Guide to Opening a Mercury Bank Account (2025 Updated)

Why Open a Mercury Bank Account in the U.S.?

Opening a U.S. bank account is now possible for non-U.S. resident LLC owners, and the process is straightforward. Mercury Bank supports account openings for non-U.S. citizens, providing an efficient banking solution for international entrepreneurs. Here’s a detailed breakdown of the process and key steps to open your account.

Common Challenges for International E-Commerce Entrepreneurs

Expanding into global markets comes with financial challenges. Some of the most common obstacles include:

Opening a U.S. business bank account (essential for receiving payments)

Limited access to virtual debit cards for online spending

High-cost international money transfers

U.S. bank account is crucial for seamless transactions and financial stability. This guide walks you through the necessary steps to open an account efficiently and securely.

Is a U.S. Bank Account Necessary for Your Business?

Yes, absolutely! If you operate a U.S.-based business, you will need a bank account to:

- Receive and send payments seamlessly.

- Reinvest your revenue to grow your business.

- Transfer funds internationally with minimal costs.

Additionally, many platforms require a U.S. bank account, such as:

- Stripe

- Amazon

- eBay

- Etsy

- Shopify

To accept payments from these platforms, opening a Mercury Bank account is a strategic move for entrepreneurs.

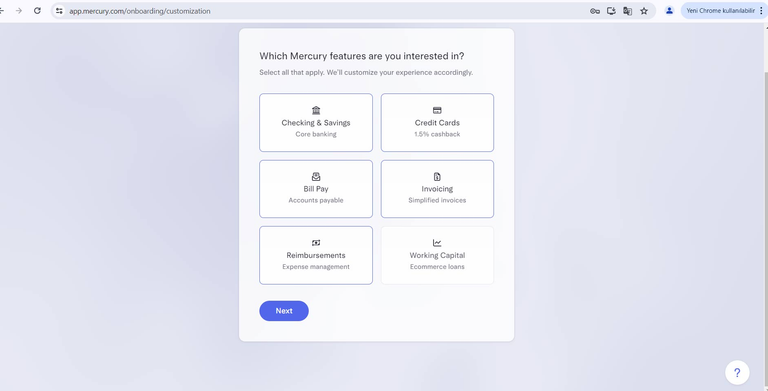

How to Open a Mercury Bank Account Online

Step-by-Step Guide to Opening a Mercury Bank Account

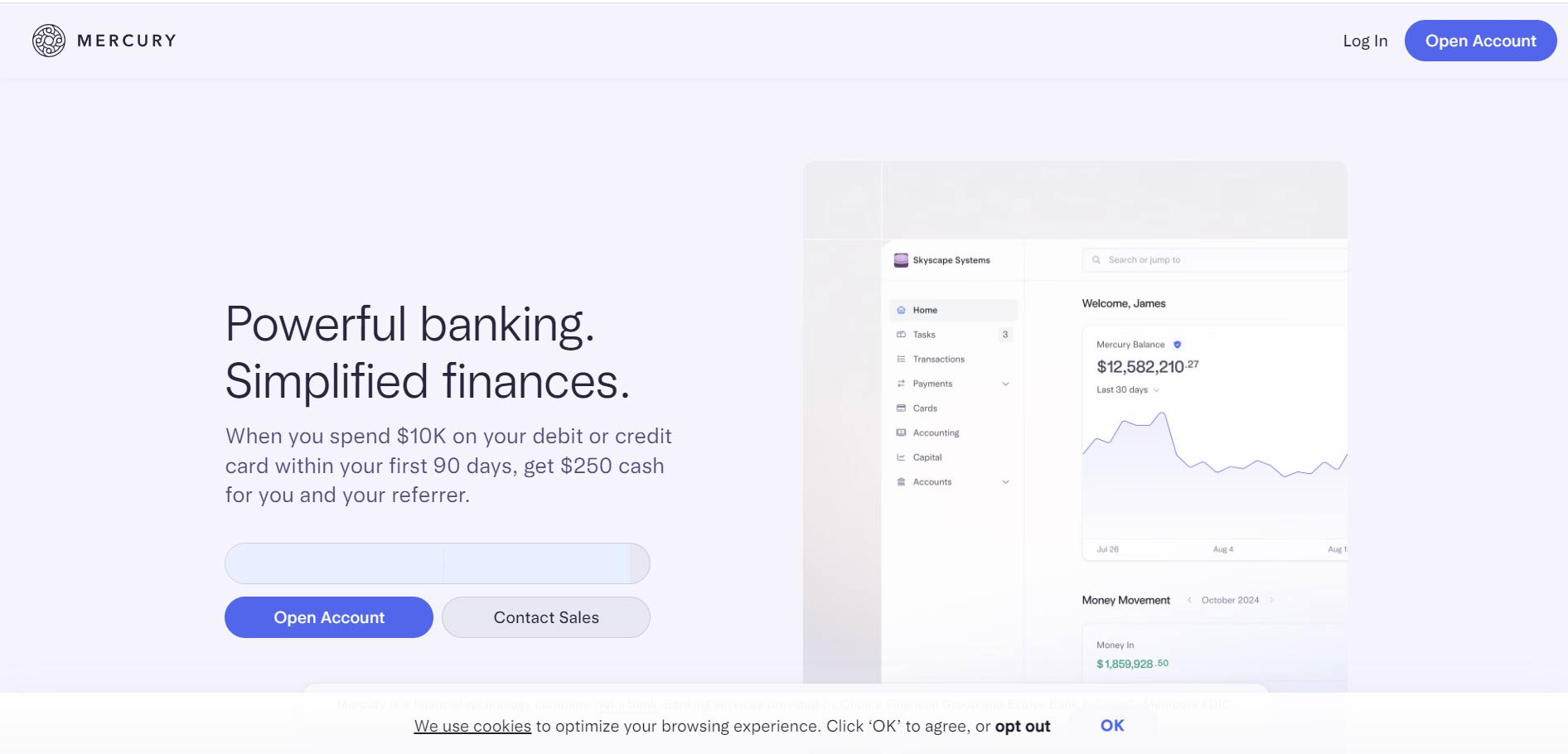

1. Visit Mercury Bank’s Website

Go to mercury.com and click “Open Account”.

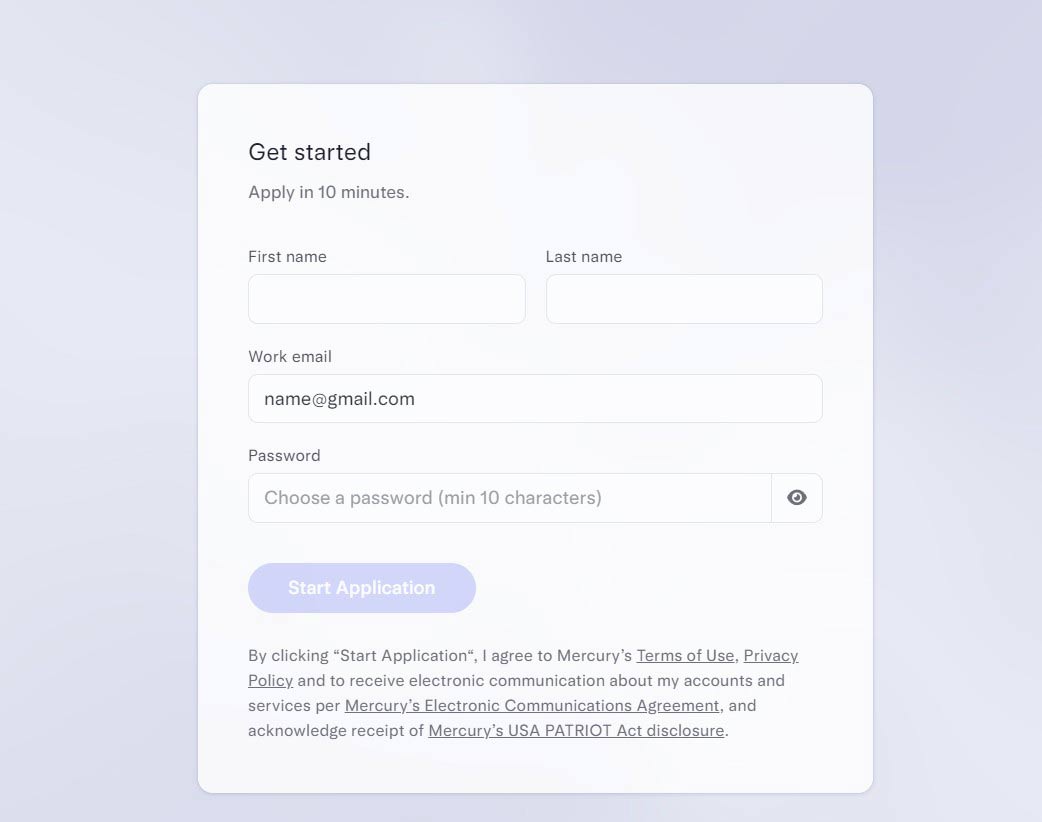

2. Register with Your Business Details

Enter your first and last name.

Provide your email address (preferably a business email).

Create a strong password.

Click “Sign Up” to proceed.

Make the right choice for your business

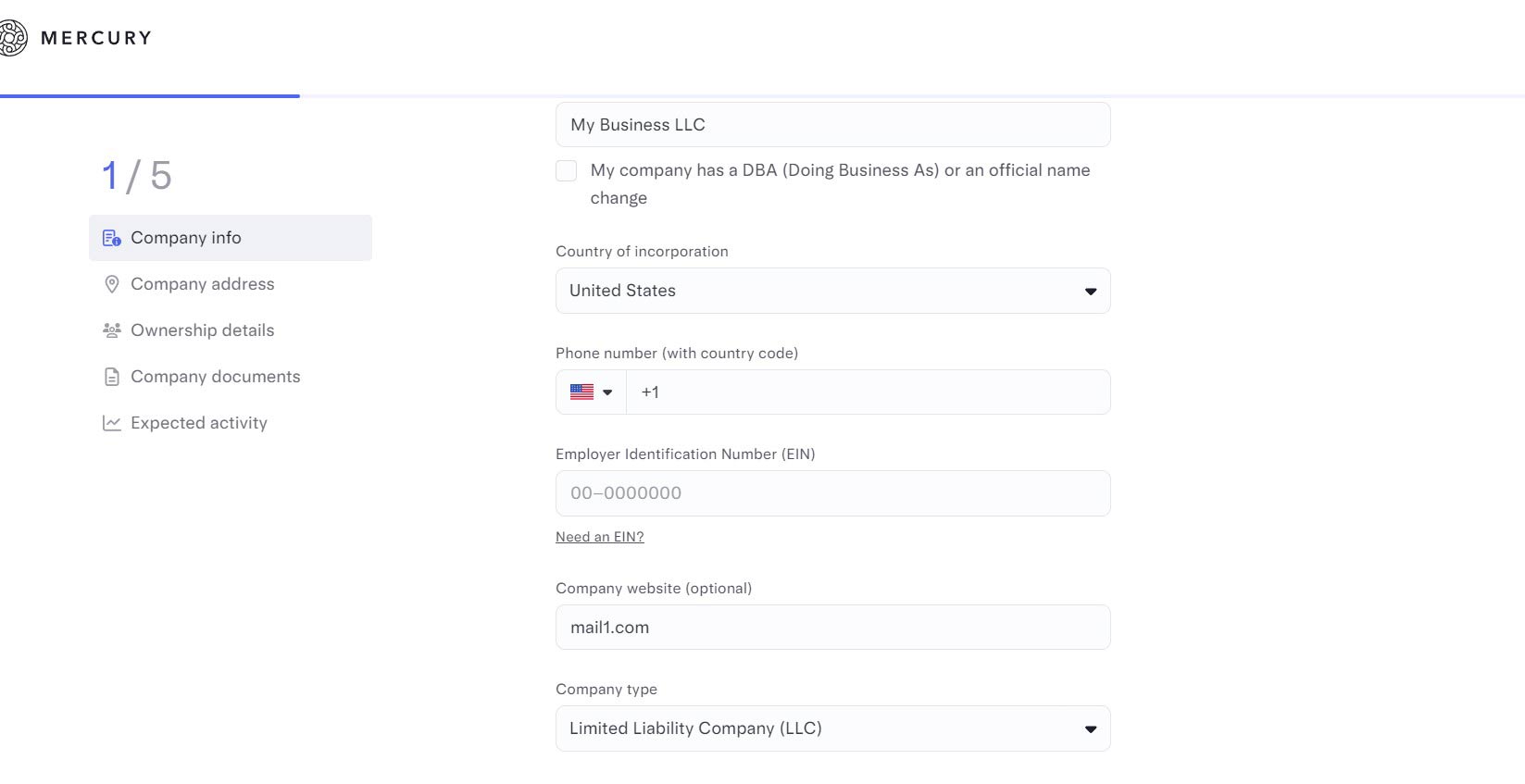

3. Enter Your Company Details

Provide your LLC or Corporation name.

Select your business entity type (LLC or Corporation).

Enter your Employer Identification Number (EIN).

Provide your business address (Mercury requires your real residential address, not a registered agent’s address).

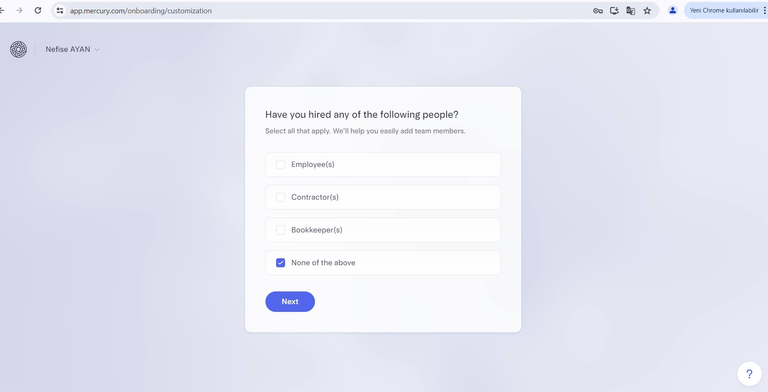

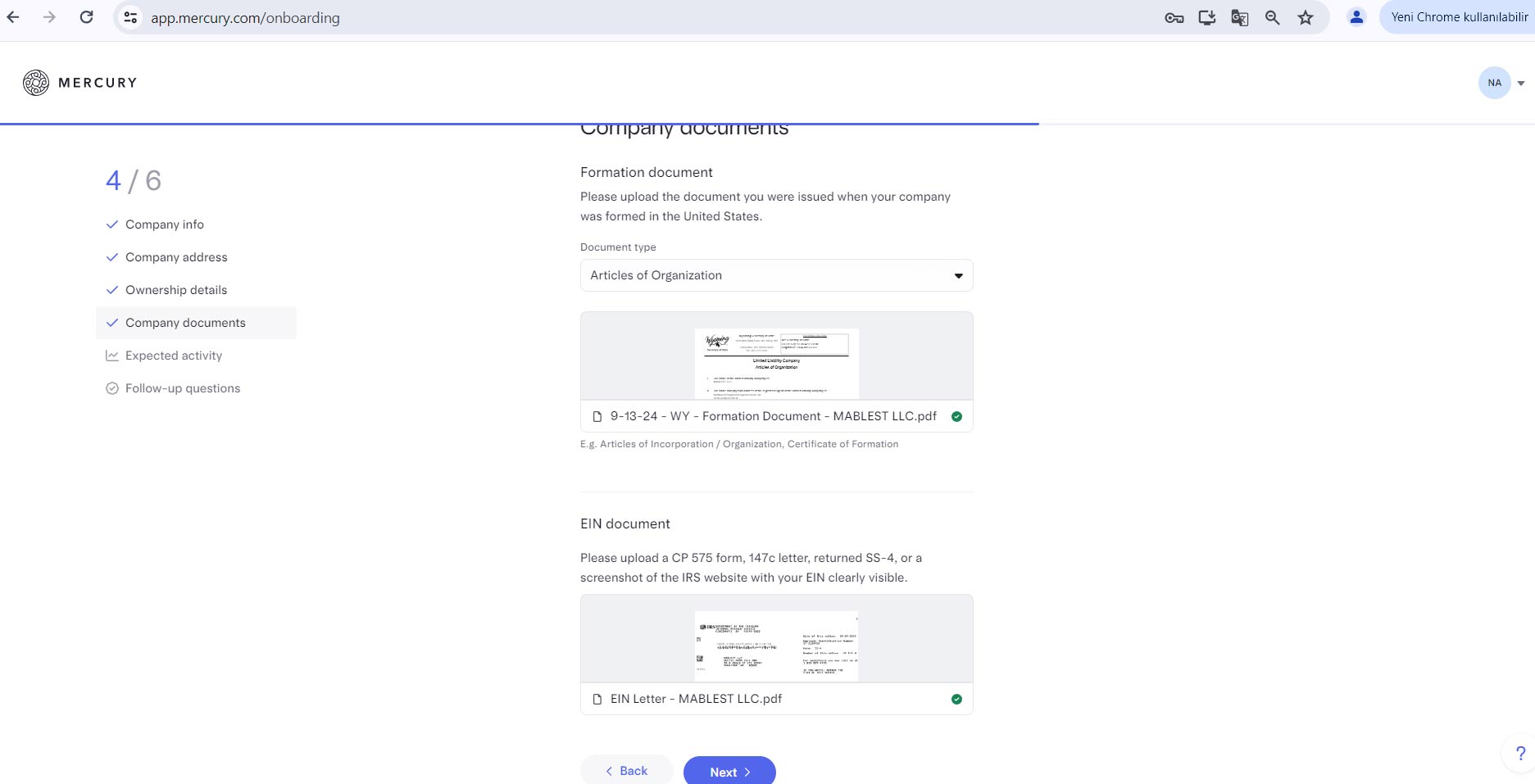

4. Upload Required Documents

Articles of Organization or Certificate of Formation.

EIN Confirmation Letter from the IRS.

A valid passport of the business owner.

A bank statement (PDF format) showing your name and address.

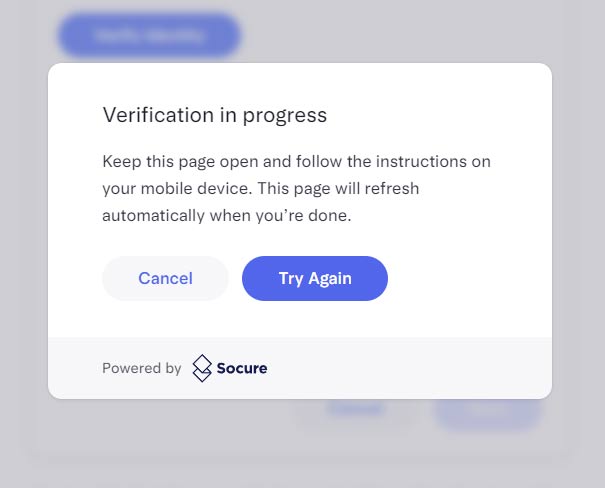

5. Verify Your Identity

Mercury Bank will prompt you to complete an identity verification process.

Use the mobile app to scan your passport.

Ensure all documents are clear and readable.

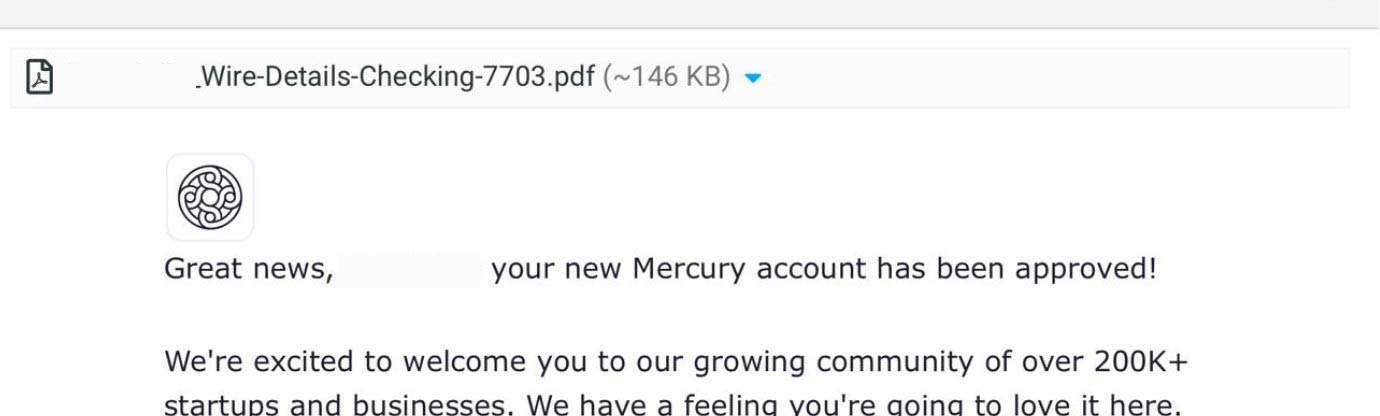

6. Wait for Account Approval

The review process usually takes 5-7 business days.

You will receive an approval email once your account is set up.

7. Receive and Activate Your Debit Card

Once approved, you can request a physical debit card.

Activate your card in the Mercury Bank dashboard.

Start making transactions and managing your finances.

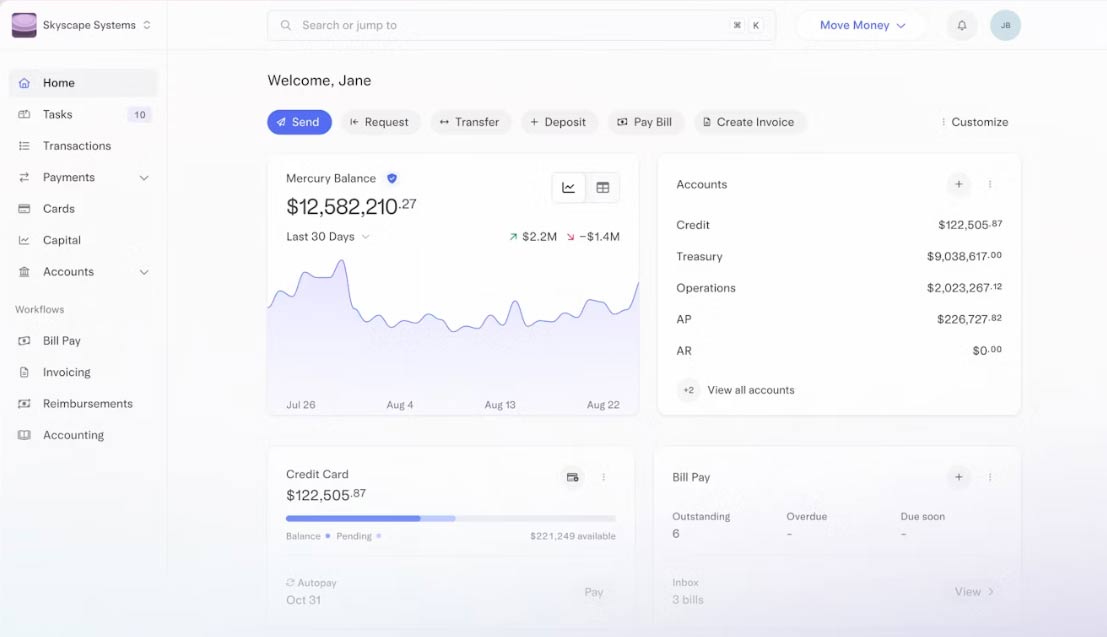

Mercury Bank: Sending Money from Your Account

How to Transfer Money Using Mercury Bank

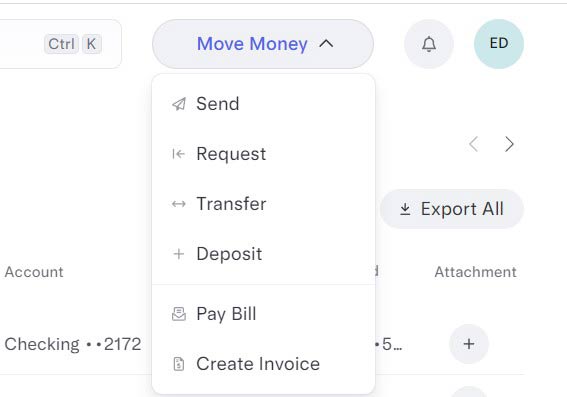

To send money from your Mercury Bank account, follow these steps:

- Log in to your Mercury Bank online banking portal.

- Navigate to “Move Money” and select “Send”.

- If the recipient is not already added, click on “Add New Recipient” and enter the required details, including the recipient's USD IBAN and bank SWIFT code.

- Enter the transfer amount.

- Choose “Send As OUR” if you want to cover all intermediary bank fees upfront (flat $15 fee). This prevents unexpected deductions from intermediary banks. Alternatively, if you choose the “Free” option, intermediary banks may deduct additional fees along the way.

- Select the account from which the funds will be sent.

- Choose “Send ON” and set the transfer date. You can send funds immediately (Today) or schedule for a future date.

Processing Time for Transfers

- Transfers are typically completed within 1-3 business days.

- In some cases, funds may arrive on the same day.

- The latest processing time is usually within 2-3 business days.

Withdrawing Cash Using Mercury Bank Debit Card

If you prefer to withdraw cash, you can use your Mercury Bank debit card. However, be aware of:

- ATM withdrawal fees, which vary by country and bank.

- Mercury Bank does not have partnered ATMs, so withdrawal costs may be high in some regions.

Alternatives to Mercury Bank

If your opening a Mercury Bank account application is denied, or you want to explore other banking options, consider these alternatives:

- Payoneer Business – Ideal for receiving international payments.

- Wise (formerly TransferWise) – Great for low-cost currency exchanges and transfers.

- Relay – A U.S. banking alternative designed for small businesses.

- Cenoa – A digital banking solution for global entrepreneurs.

- AirWallex – Excellent for businesses needing multi-currency accounts.

These platforms provide business-friendly banking solutions and may serve as alternatives to opening a Mercury Bank account, depending on your needs.

Frequently Asked Questions (FAQs) About Mercury Bank

1. Who can open a Mercury Bank account?

Mercury Bank accounts are available for U.S. LLCs and Corporations, including those owned by non-U.S. residents.

2. Do I need a U.S. address to open a Mercury Bank account?

No, but you must provide your residential address and a bank statement to verify it.

3. Does Mercury Bank charge monthly fees?

No, Mercury Bank does not charge monthly maintenance fees or require a minimum balance.

4. How long does it take to open an account?

The approval process typically takes 5-7 business days, depending on document verification.

5. Can I open a personal account with Mercury Bank?

No, Mercury Bank only offers business accounts for LLCs and Corporations.

6. Does Mercury Bank provide a debit card?

Yes, Mercury Bank offers both physical and virtual debit cards for online transactions and ATM withdrawals.

7. Can I send international wire transfers with Mercury Bank?

Yes, Mercury Bank supports international wire transfers, typically processed within 1-3 business days.

8. What is the fee for international transfers?

Mercury Bank charges a flat $15 fee for international wire transfers.

9. Does Mercury Bank work with Stripe and PayPal?

Yes, Mercury Bank integrates seamlessly with Stripe, PayPal, and other payment processors.

10. Can I receive payments from Amazon or Shopify?

Yes, Mercury Bank accounts can be used to receive payments from platforms like Amazon, Shopify, and eBay.

11. Does Mercury Bank require an ITIN or SSN?

No, an ITIN or SSN is not required; only an EIN is needed.

12. Can I use a registered agent address for my business?

No, Mercury Bank requires your actual residential address for verification.

13. How secure is Mercury Bank?

Mercury Bank is FDIC-insured and follows high security standards.

14. Is Mercury Bank a traditional bank?

No, Mercury Bank is a financial technology (fintech) platform, but funds are held in FDIC-insured partner banks.

15. Can I withdraw cash using my Mercury Bank debit card?

Yes, but ATM fees vary depending on the provider and country.

16. Can I use Mercury Bank for cryptocurrency transactions?

No, Mercury Bank does not support crypto-related transactions.

17. What happens if my account application is denied?

You can try alternatives like Wise, Payoneer, or Relay.

18. Does Mercury Bank offer business credit cards?

No, Mercury Bank only provides debit cards, not credit cards.

19. Can I have multiple users on my account?

Yes, you can add team members and set different permission levels.

20. How do I contact Mercury Bank support?

You can reach Mercury Bank via email or live chat on their official website.

Final Thoughts

Opening a Mercury Bank account is a game-changer for non-U.S. entrepreneurs who need a U.S. business bank account. With no hidden fees, an easy online application, and international-friendly features, it’s one of the best solutions for e-commerce, startups, and online businesses.

If you are expanding globally, opening a Mercury Bank account and forming an LLC is a smart move!

🚀 Start your application today at mercury.com.