How To Create A Stripe Account For Non US Residents Without SSN [2025 Updated]

If you're a non-US resident looking to accept payments globally, you've probably realized that opening a Stripe account isn’t as straightforward as it is for US citizens.

Stripe, one of the most trusted payment gateways worldwide, allows businesses to receive payments seamlessly.

However, non-residents often struggle with account approval due to certain restrictionsespecially the lack of an SSN or ITIN.

But here’s the good news: It is absolutely possible to create a Stripe account as a non-US resident!

You just need to follow the right process. This guide will walk you through everything from forming a US LLC to obtaining an EIN and setting up a US bank account.

By the end of this tutorial, you’ll have a fully functional Stripe account, legally verified and ready to accept payments from customers worldwide.

What You’ll Learn in This Guide:

✔️ Why a US LLC is essential for non-residents to open a Stripe account

✔️ Step-by-step instructions for forming your LLC, getting an EIN, and opening a US bank account

✔️ Common mistakes to avoid during the setup process

✔️ The easiest way to get your Stripe account approved

So, if you’re ready to unlock global payments with Stripe, let’s dive in! 🚀

What Is a US Stripe Account and Why Is It Important?

Stripe is one of the most popular and widely used online payment gateways, enabling businesses to accept payments from customers worldwide. It is known for its seamless integration, advanced fraud protection, and extensive developer-friendly features. Many US-based entrepreneurs and business owners can easily create a Stripe account with just a few clicks, using their Social Security Number (SSN) and a US-based bank account.

However, for non-US residents, the process is not that simple. Stripe operates in select countries, meaning that many entrepreneurs from unsupported regions are unable to create an account directly. This limitation prevents international business owners from legally accepting payments through one of the most trusted payment gateways in the world.

Why Can’t Non-US Residents Easily Open a Stripe Account?

The main reason non-US residents face difficulties with Stripe is the lack of a US business entity and the required tax identification numbers. Unlike US citizens who can sign up with their personal details, non-residents must provide:

✅ A registered US business (an LLC, in most cases)

✅ A US-based address for the business

✅ An Employer Identification Number (EIN) (a tax ID issued by the IRS)

✅ A US bank account for Stripe payouts

Without these elements, non-residents are not eligible for a US Stripe account. This is where forming a US LLC becomes essential—it allows foreign entrepreneurs to legally register a business in the US and qualify for a Stripe account without needing a Social Security Number (SSN) or ITIN.

How Can Non-US Residents Use Stripe?

Despite these restrictions, there is a way for non-residents to open a fully functional US Stripe account. By forming a Limited Liability Company (LLC) in a Stripe-supported state like New Mexico, Wyoming, or Delaware, and obtaining an EIN and US bank account, you can unlock the benefits of Stripe and start receiving payments internationally.

In the next section, we will explore the major advantages of having a US Stripe account, and why it’s worth considering for your global business. 🚀

Benefits of Having a US Stripe Account

If you're planning to expand your business globally, having a US Stripe account offers significant advantages. Stripe is a trusted and secure payment processor used by millions of businesses worldwide, and it provides a seamless way to accept online payments.

For non-US residents, opening a US Stripe account comes with unique benefits that can help scale your business efficiently. Let’s explore why having a US-based Stripe account is a game-changer:

1. Trust & Security 🔒

✔️ Stripe is one of the most trusted payment gateways in the world, handling billions of dollars in transactions every year.

✔️ Consumers feel more confident purchasing from businesses that use a globally recognized payment processor.

✔️ Advanced fraud protection and security features safeguard your transactions and customers' sensitive data.

2. Accept Payments from US Customers Easily 💳

✔️ The US is the world’s largest online market, and many US customers prefer paying through trusted gateways like Stripe.

✔️ With a US Stripe account, you can accept payments directly from US-based clients without any geographical restrictions.

3. Global Payment Processing Made Simple 🌍

✔️ Stripe supports over 135 currencies, allowing you to receive payments from customers worldwide.

✔️ You can accept payments via credit cards, debit cards, Apple Pay, Google Pay, and bank transfers effortlessly.

✔️ Recurring billing and subscription management make it ideal for SaaS businesses, membership sites, and online services.

4. Easy Integration with Popular Platforms 🖥️

✔️ Stripe can be integrated with Shopify, WooCommerce, WordPress, Wix, and other eCommerce platforms with just a few clicks.

✔️ Developers can use Stripe’s robust API to create custom payment solutions for mobile apps, websites, or online businesses.

5. Access to Stripe’s Free Business Tools & Features 🚀

✔️ Stripe provides powerful analytics, real-time reporting, and an easy-to-use dashboard to track payments.

✔️ Built-in tools like invoice generation, dispute management, and automatic tax collection simplify business operations.

6. One of the Easiest Payment Gateways to Get Approved For ✅

✔️ Many payment processors have strict requirements for approval, but Stripe is one of the easiest to set up—if you follow the right steps.

✔️ By forming a US LLC and providing the necessary details (EIN, US bank account, business address), your approval chances significantly increase.

7. Excellent Support & Documentation 📚

✔️ Stripe offers detailed documentation and tutorials to guide you through integrations, payments, and troubleshooting.

✔️ 24/7 customer support ensures that you get assistance whenever you need it.

A US Stripe account is an invaluable tool for non-US entrepreneurs, making it easy to accept payments globally, integrate with various platforms, and grow your business.

Now that you understand the key advantages, let’s move on to the eligibility and requirements for non-US residents to open a Stripe account! 🚀

Can Non-US Citizens Use Stripe?

The short answer is: Yes! Non-US citizens can legally use Stripe—but there are specific requirements you must meet to get your account approved. Unlike US residents who can sign up with just their Social Security Number (SSN) and personal bank account, non-US entrepreneurs need to go through a structured process to qualify for a US Stripe account.

Fortunately, you do not need to be a US citizen or have an SSN to open a fully functional and legal Stripe account. Instead, you will need to set up a US-based business entity and fulfill a few essential requirements.

Let’s break down the process step by step:

✅ How Can Non-US Residents Open a Stripe Account?

To successfully open a Stripe account as a non-US resident, you will need to complete the following steps:

1️⃣ Form a US LLC (Limited Liability Company)

✔️ Stripe requires a business entity registered in the US.

✔️ The most popular choice for non-residents is an LLC (Limited Liability Company).

✔️ Recommended states for forming an LLC: New Mexico, Wyoming, or Delaware (no state taxes for non-residents).

✔️ You do not need to live in the US or have a visa to start an LLC.

2️⃣ Obtain an EIN (Employer Identification Number)

✔️ After forming an LLC, you must apply for an EIN from the IRS (Internal Revenue Service).

✔️ This tax identification number is required to open a US business bank account and register with Stripe.

✔️ You can apply for an EIN without an SSN or ITIN.

3️⃣ Open a US Business Bank Account

✔️ Stripe requires a US-based bank account to deposit your funds.

✔️ Some online banks and fintech platforms allow non-residents to open business bank accounts remotely.

✔️ Popular options: Mercury, Relay, Wise (formerly TransferWise).

4️⃣ Complete Stripe’s Identity Verification Process

✔️ After setting up your LLC and business bank account, you can register for a US Stripe account.

✔️ Stripe will require identity verification, where you must submit:

- Your passport or national ID

- Your LLC details (company name, EIN, US address, etc.)

✔️ The information you provide must be accurate and match your legal business details to ensure smooth approval.

🔹 Important Notes:

❗ Your personal address can be outside the US, but your business address must be a US-based address (provided by your registered agent).

❗ Stripe does not require a US phone number—you can use your own international phone number.

❗ It’s essential to use the correct business classification when registering with Stripe to avoid approval issues.

While non-US citizens cannot open a Stripe account as individuals, they can do so through a legally registered US LLC. Once you have your LLC, EIN, and business bank account, getting approved for Stripe is straightforward.

In the next section, we will go deeper into the exact requirements needed to ensure a smooth and successful Stripe account setup! 🚀

You’re One Step Closer to Your US Stripe Account! 🚀

By now, you understand that non-US residents can legally create a Stripe account, but it requires following the right steps. The good news? If you complete each requirement correctly, your US Stripe account will be fully functional and ready to accept payments!

Many entrepreneurs give up because they believe opening a Stripe account as a non-resident is complicated. But in reality, it’s just a process—one that this guide will walk you through step by step.

✅ Once you set up your US LLC, obtain your EIN, and open a business bank account, you’ll be able to register your Stripe account with confidence.

✅ Stripe will recognize your business as a legitimate US entity, allowing you to seamlessly accept payments from US-based and international customers.

We know how important this process is for your business, and that’s why we’ve created this in-depth guide—so you don’t have to figure it out on your own.

👉 Make sure you follow each section carefully to avoid mistakes.

👉 By the end of this guide, you’ll have a fully operational Stripe account and the ability to process global payments.

Ready to move forward? Let's dive into the detailed requirements and ensure you have everything set up for a smooth Stripe account approval! ✅

How to Create a Stripe Account for Non-US Residents

Setting up a US Stripe account as a non-US resident may seem complicated at first, but in reality, it’s a step-by-step process that, when followed correctly, allows you to accept payments globally with ease.

To legally open a Stripe account, you cannot use a company registered in your home country. Stripe requires businesses to provide specific legal and financial documents that are only available with a US-based business entity.

This means that forming a US LLC is the most effective and legitimate way for non-residents to get approved for a Stripe account.

Now, let’s go over the essential requirements for using Stripe as a non-US resident.

Requirements for Using a US Stripe Account as a Non-Resident

To successfully create a US Stripe account, you need to fulfill four key requirements:

1️⃣ A US-Based Business (LLC Formation)

✔️ Non-US companies cannot register directly with Stripe—you need a US-registered LLC.

✔️ Forming an LLC is straightforward and can be done 100% online without needing to visit the US.

✔️ The best states for non-residents are New Mexico, Wyoming, and Delaware, as they offer low costs, privacy protection, and no state taxes for foreign-owned LLCs.

✔️ An LLC provides legal protection, credibility, and ensures compliance with Stripe’s business registration requirements.

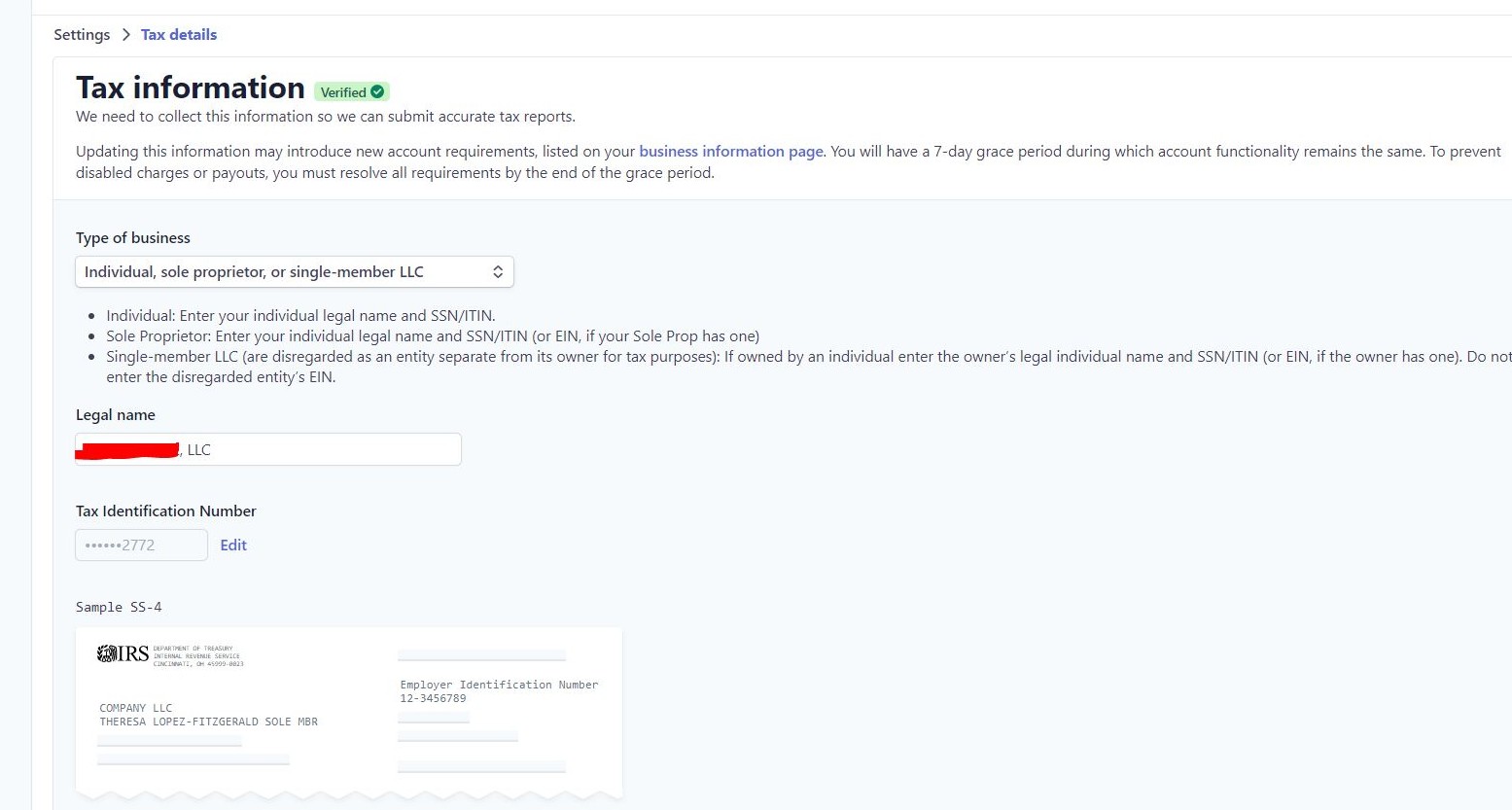

2️⃣ Employer Identification Number (EIN) from the IRS

✔️ Stripe requires your business to have an EIN (Employer Identification Number), which is issued by the IRS (Internal Revenue Service).

✔️ You do not need a Social Security Number (SSN) to get an EIN.

✔️ The EIN is necessary to open a US business bank account and complete your Stripe verification process.

3️⃣ A US Business Bank Account

✔️ Stripe deposits funds into a US-based business bank account, so having one is mandatory.

✔️ Many online banking services allow non-residents to open a US business account remotely (e.g., Mercury, Relay, Wise).

✔️ Your business bank account must match your LLC details, ensuring that all transactions align with your legal entity.

4️⃣ Identity Verification & Compliance with Stripe

✔️ Stripe will ask you to verify your identity during the registration process.

✔️ You need to submit a government-issued ID (passport or national ID) and your US LLC business details.

✔️ Your Stripe business profile must be set up correctly, ensuring all details are accurate to avoid delays or rejections.

💡 LLC Formation: Easier Than You Think

Many non-residents assume forming an LLC in the US is complicated—but it’s actually a simple and structured process:

✅ Step 1: Register your US LLC online (takes 1-2 days with a service like Northwest Registered Agent).

✅ Step 2: Apply for your EIN (can take 4-6 weeks, but expedited services are available).

✅ Step 3: Open a US business bank account (you can apply remotely through online banking services).

✅ Step 4: Register for Stripe, complete verification, and start accepting payments worldwide.

Once your LLC is set up and all the requirements are met, getting approved for a Stripe account is easy and hassle-free! 🚀

In the next section, we will dive deeper into each requirement, starting with LLC formation and why it is the foundation of your Stripe account setup.

What is a US LLC and Why is it Essential for Non-US Residents Using Stripe?

If you’re a non-US resident looking to open a Stripe account, the first and most important step is forming a US LLC (Limited Liability Company). Stripe requires a legally registered US business for non-residents, and an LLC is the most accessible and cost-effective option.

Now, let’s break down what an LLC is, why it’s the best choice for non-residents, and how it makes getting approved for Stripe easy and straightforward.

✅ What is a US LLC?

A Limited Liability Company (LLC) is a legal business structure in the United States that offers:

✔️ Limited liability protection – Your personal assets remain separate from your business debts.

✔️ Pass-through taxation – Non-US residents don’t pay US corporate taxes unless they have a taxable presence in the US.

✔️ Business credibility – A registered LLC increases trust when working with US clients and global customers.

Unlike sole proprietorships, an LLC is treated as a separate legal entity, which is why Stripe recognizes it as a legitimate business for account registration.

🌍 Why is an LLC the Best Choice for Non-US Residents?

If you’re a foreign entrepreneur, an LLC is the most practical way to set up a business in the US without physically being there. Here’s why:

✔️ No residency or visa required – You don’t need to live in the US to start or own an LLC.

✔️ No SSN or ITIN required – Unlike corporations, LLCs allow foreign owners to apply for an EIN (Employer Identification Number) without a Social Security Number (SSN).

✔️ Easier tax structure – Most non-US LLC owners only pay taxes in their own country, not in the US (if structured properly).

✔️ 100% remote setup – You can register an LLC fully online without traveling to the US.

Once your LLC is formed, you can apply for an EIN, open a US business bank account, and register for Stripe—allowing you to legally receive payments from US and international customers.

🛠️ How an LLC Helps You Get Approved for Stripe

Without a US LLC, Stripe will not approve your account as a non-resident. Here’s how forming an LLC solves this issue:

❌ A company registered in your home country is NOT accepted by Stripe US.

✅ A US-based LLC meets all of Stripe’s legal requirements for non-residents.

Once your LLC is created, you’ll receive:

✔️ A registered business name – Needed for Stripe account verification.

✔️ A US business address – Provided by your registered agent, required for Stripe registration.

✔️ An EIN (Employer Identification Number) – Essential for business tax purposes and bank account setup.

With these details in place, your Stripe account setup will be smooth and straightforward.

💡 Forming a US LLC is Easier Than You Think

Many non-residents assume that setting up an LLC is a complicated process, but in reality, it’s fast and simple when you follow the right steps:

✅ Choose the Best State – New Mexico : Our recommendation is New Mexico, which is the state with no annual reporting and the lowest cost of entry.

✅ Register Your LLC Online – You can use a formation service like Northwest Registered Agent to handle everything.

✅ Receive Your LLC Documents – Usually within 1-2 business days.

✅ Apply for an EIN – You’ll need this for your bank account and Stripe registration.

✅ Open a US Business Bank Account – Required for receiving payments from Stripe.

Once these steps are completed, your US Stripe account will be ready for activation! 🚀

In the next section, we’ll cover how to get a US business address and why it’s required for Stripe registration.

Why Do You Need a US Business Address for a Stripe Account?

One of the key requirements for opening a US Stripe account as a non-resident is providing a US business address. Stripe requires this address to verify your LLC registration and confirm that your business operates within the US.

But don’t worry—you don’t need to rent an office or live in the US to meet this requirement!

✅ How to Get a US Business Address Easily

✔️ When you form an LLC through a registered agent service, they typically provide a business address for free as part of the package.

✔️ This business address is used for official correspondence, including IRS letters, EIN registration, and bank account setup.

✔️ You can use this address to register your Stripe account, ensuring compliance with their requirements.

💡 Important Notes

❗ This business address is NOT a mailing address for receiving physical packages it’s strictly for legal and business purposes.

❗ If you need a virtual mailbox for mail forwarding, many registered agents offer this as an additional service.

Setting up a US business address is automatic when you register your LLC, so you don’t need to worry about finding one separately.

In the next section, we’ll cover whether you need a US phone number for Stripe or if your international number is sufficient. 🚀

Do You Need a US Phone Number for Stripe?

No, you do not need a US phone number to open a Stripe account as a non-US resident.

✔️ Stripe allows you to use your own international mobile number for verification.

✔️ A US-based phone number is not required at any stage of the registration process.

✔️ You will receive verification codes and account notifications via your existing phone number.

So, there’s no need to purchase a US virtual number—your current mobile number works just fine! ✅

Next, we’ll cover why an EIN (Employer Identification Number) is necessary for Stripe and how to get one as a non-US resident. 🚀

Why Do You Need an EIN for Stripe & How to Get One?

An Employer Identification Number (EIN) is a mandatory requirement for non-US residents opening a US Stripe account.

✔️ Why is an EIN necessary?

- Stripe requires an EIN to verify your US business entity.

- It is needed to open a US business bank account, which is required for Stripe payouts.

- The IRS issues EINs for tax purposes, even if you don’t owe US taxes.

✔️ How to Get an EIN?

- You can apply for an EIN without an SSN or ITIN.

- The application is free and can be done via mail or fax using Form SS-4.

- Processing takes 4-6 weeks, but expedited services are available.

We’ve already covered how to apply for an EIN as a non-US resident in detail. 👉 Read the full EIN guide

Next, let’s discuss why you need a US business bank account before applying for Stripe. 🚀

Why Do You Need a US Business Bank Account for Stripe?

A US business bank account is a mandatory requirement for setting up a Stripe account as a non-US resident.

✔️ Why is it required?

- Stripe deposits payouts directly into your US bank account after deducting processing fees.

- Without a US-based account, Stripe cannot transfer your funds.

✔️ Important Notes:

- The bank account must belong to your US LLC, not your personal account.

- You must open a bank account before applying for Stripe, as you’ll need to enter your banking details during registration.

We’ve covered how to open a US bank account as a non-resident in detail. 👉 Read the full guide here

Now that you have all the requirements, let’s move on to the step-by-step process of forming an LLC and setting up your Stripe account! 🚀

Next Step: Forming Your US LLC

Now that we’ve covered all the essential requirements for opening a US Stripe account, it's time to take the first major step: forming your LLC.

A US LLC (Limited Liability Company) is the foundation of your Stripe account setup. Without it, Stripe will not recognize your business as a legitimate US entity, and your account will not be approved.

The good news? Forming an LLC is a straightforward process, and you can do it entirely online! ✅

Among the many US states where you can form an LLC, New Mexico stands out as the best choice for non-residents due to its low cost and business-friendly policies.

Let’s explore why New Mexico is the most affordable and efficient option for setting up your LLC.

Why New Mexico is the Best State for Your LLC

If you're a non-US resident looking for the most cost-effective and hassle-free way to form an LLC, New Mexico is an excellent choice.

Here’s why:

✔️ No Annual Reports or Renewal Fees – Unlike most states, New Mexico does not require LLCs to file annual reports or pay yearly renewal fees. This saves you time and money.

✔️ No State Taxes for Foreign-Owned LLCs –If you do not operate a physical store or shop in the United States and do not have a physical office there, you do not pay state taxes in New Mexico.

✔️ Low Formation Cost – The filing fee is only $50, making it one of the cheapest states to form an LLC.

✔️ Privacy Protection (Anonymous LLC Option) – New Mexico LLC owners' names are not publicly listed, providing an extra layer of privacy.

✔️ Fast & Easy Formation – The LLC registration process in New Mexico is quick and straightforward, with approval typically taking 1-2 business days.

With no annual maintenance fees, tax benefits, and strong privacy protection, New Mexico is the ideal choice for non-US residents looking to form a US LLC.

In the next section, we will break down the exact step-by-step process of forming an LLC in New Mexico. 🚀

How to Form an LLC in New Mexico (Step-by-Step Guide)

Forming an LLC in New Mexico is a simple and fully online process—even for non-US residents. You don’t need to visit the US, have a Social Security Number (SSN), ITIN, or even a passport to register your business.

Thanks to trusted LLC formation services like Northwest Registered Agent, you can set up your LLC remotely in just a few steps.

✔️ The process is quick and straightforward, typically taking 1-2 business days.

✔️ Everything is done online, meaning you can form your LLC from anywhere in the world.

✔️ Northwest Registered Agent handles all the paperwork, including your Articles of Organization and Registered Agent services.

Once your LLC is successfully registered, you will receive your official formation documents, allowing you to apply for an EIN, open a US business bank account, and get your Stripe account approved.

📌 Next Step: Step-by-Step Formation Guide

In the next section, we will walk you through each step of the LLC formation process, complete with screenshots and instructions to make it even easier for you. 🚀

Forming an LLC can be quite costly under normal circumstances. If you hire a lawyer or an accountant, it could cost you $1,000 or more.

But there’s a more affordable and reliable option—you can form an LLC for less than $100!

This is possible in states with low filing fees. For example, in New Mexico, the LLC formation filing fee is only $52—making it one of the most cost-effective options for non-US residents. ✅

The quickest and most effective way to form a US LLC in New Mexico is by using a professional LLC formation service.

In this guide, we recommend Northwest Registered Agent—a trusted and reputable provider for LLC formation services.

Forming your LLC with Northwest Registered Agent is highly cost-effective, ensuring a smooth and hassle-free registration process. ✅

Follow These Steps To Form Your New Mexico LLC

Step 1 : To get started, go to Northwest Registered Agent’s website and click “LET'S GET YOU STARTED”.

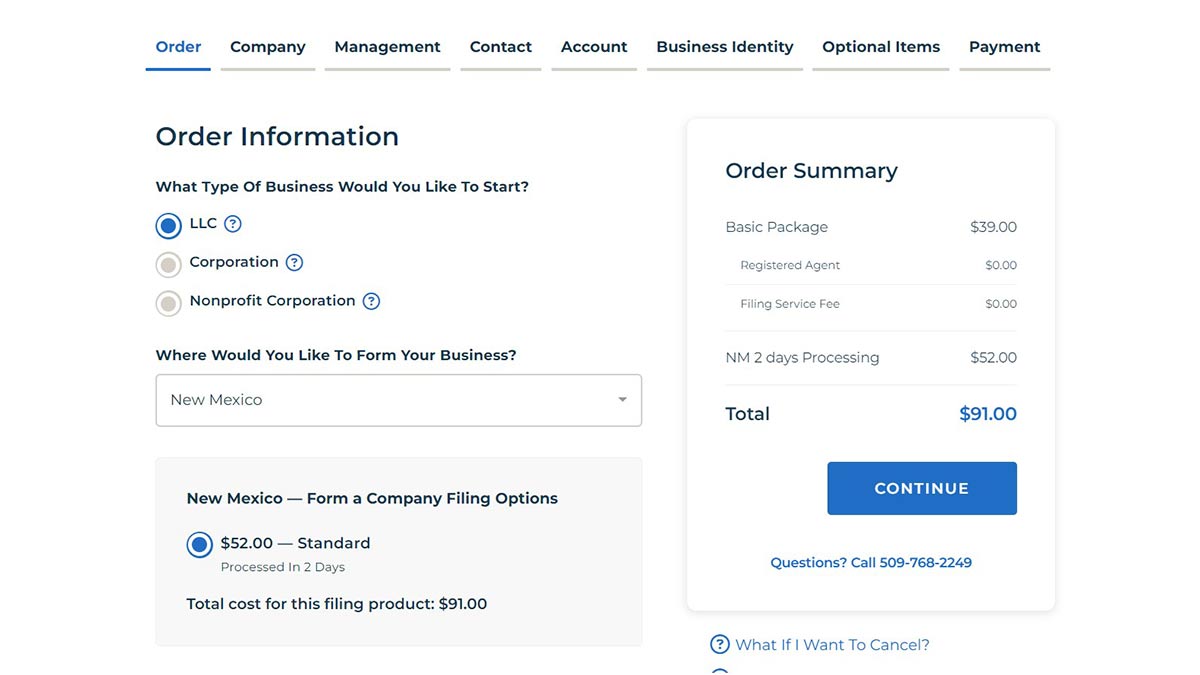

Step 2: Select New Mexico as Your LLC's State

On the formation page, select New Mexico as your LLC’s state.

You will see the total cost breakdown:

$52 state filing fee.

$39 Northwest formation fee.

Total: $91 (including business address and first-year Registered Agent service).

Click “Continue” to proceed.

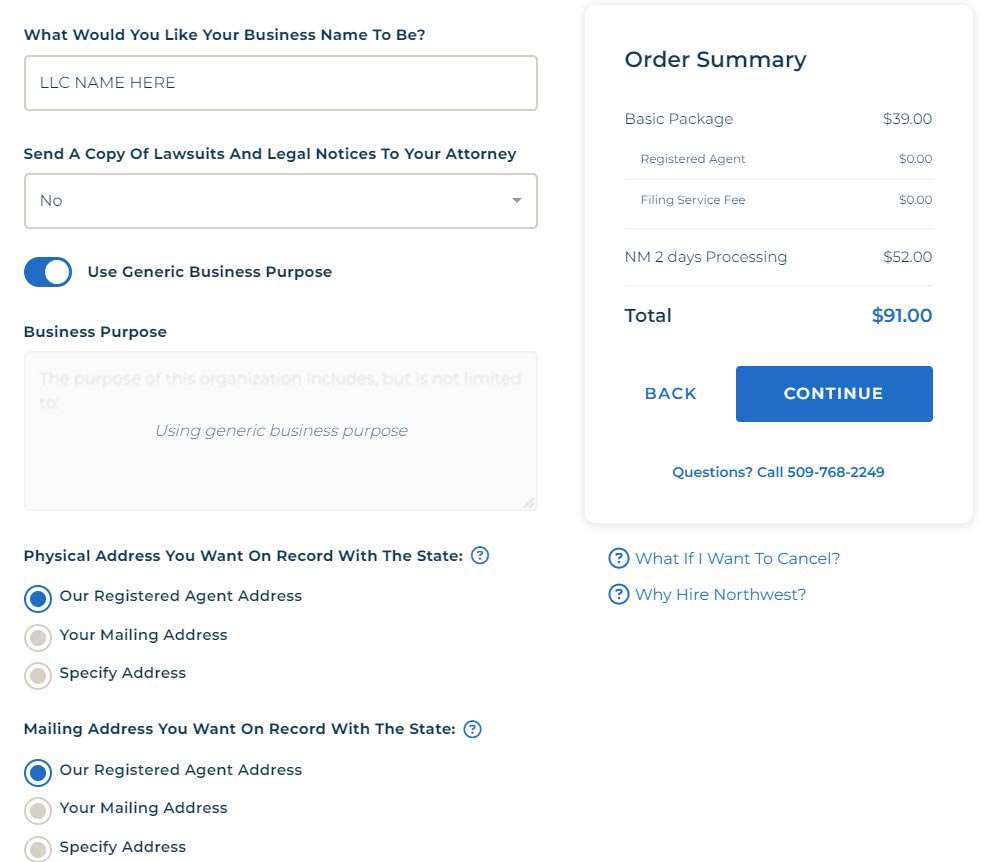

Step 3: Enter Your LLC Name

Type your desired LLC name.

Ensure it includes "LLC" or "Limited Liability Company" at the end.

Enter a brief business purpose (e.g., "E-commerce consulting").

Step 4: Registered Agent & Address

Northwest provides a free business address.

Leave the address section as is (Northwest’s address will be used).

📌 If you do not have a specific company and mailing address, you can leave the selections as is

Click “Continue.”

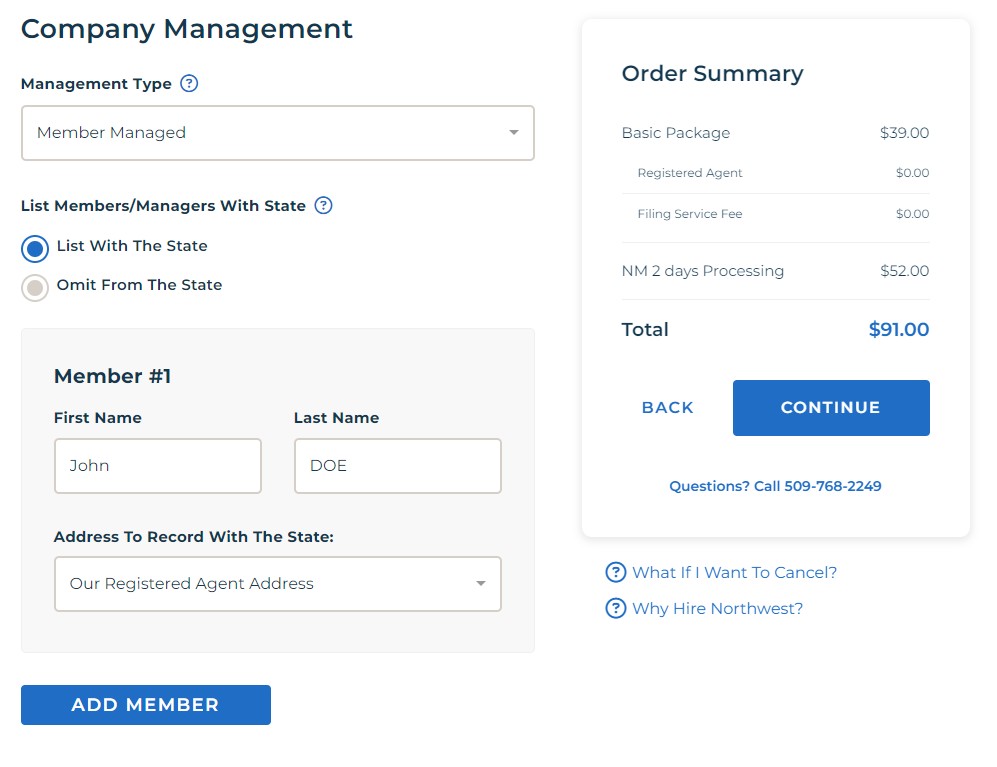

Step 5: Management Structure

Select “Member-Managed” if you will run the business yourself.

Select “Manager-Managed” if you want to appoint managers.

📌 If you want to create a multi member llc, you can add multiple members. To do this, click on the "Add Member" button and add members.

Click “Continue.”

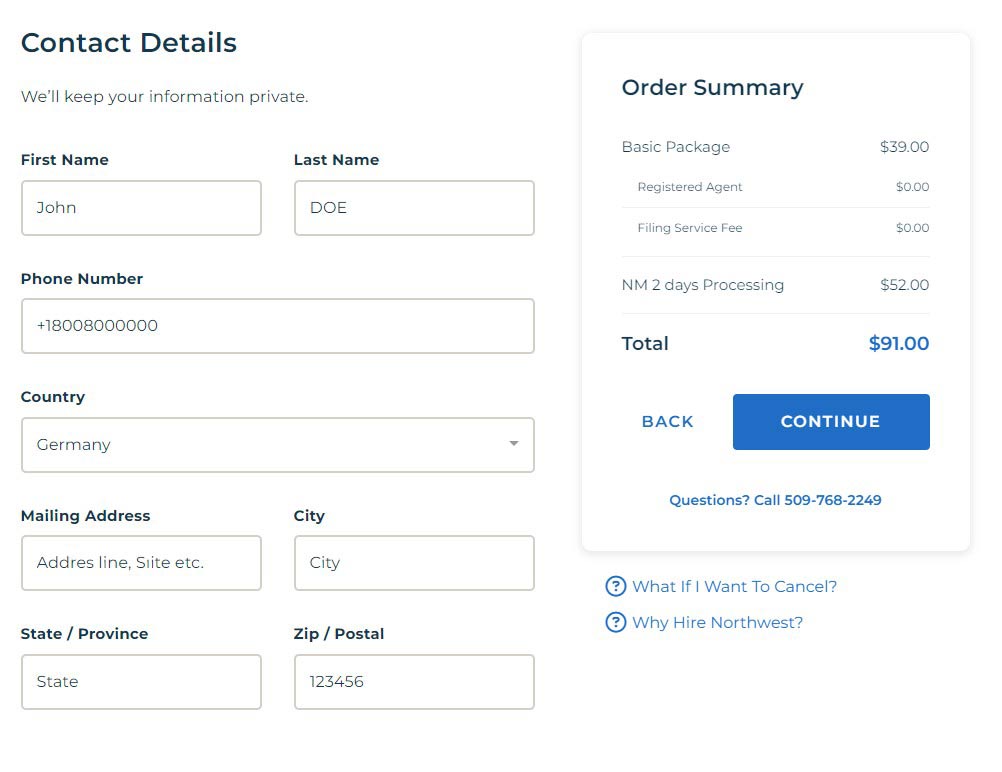

Step 6: Contact Information

Enter your email address and create a password.

Provide your home country address (can be outside the U.S.).

Add your phone number.

Select “No” for legal notices.

Click “Continue.”

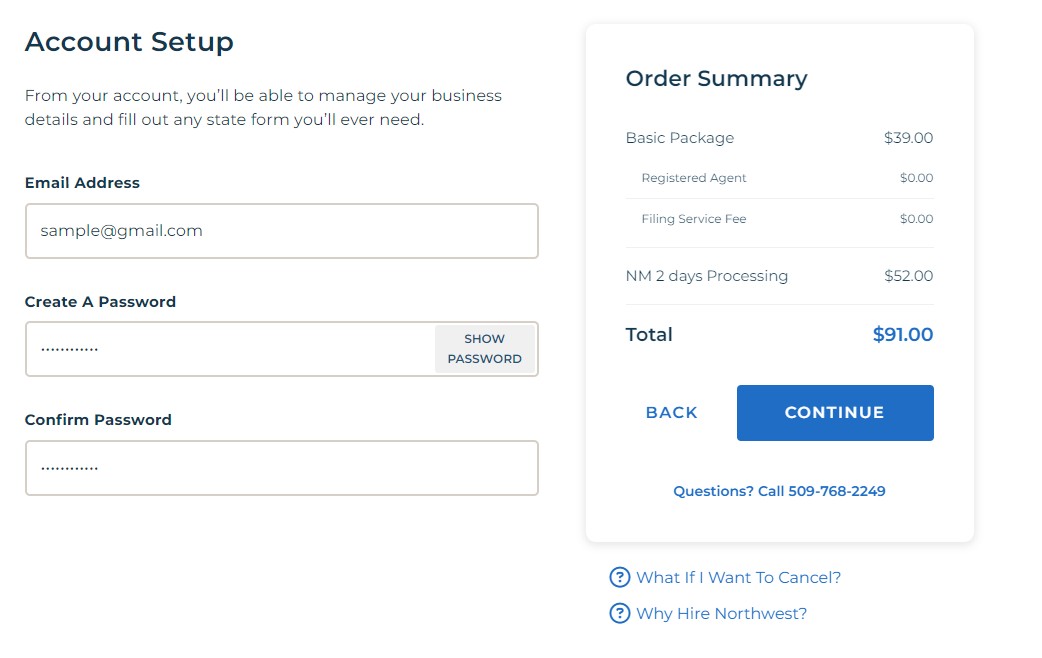

Step 7: Account Setup

In this step, you need to create an email and password for your Northwest customer panel.

Click “Continue.”

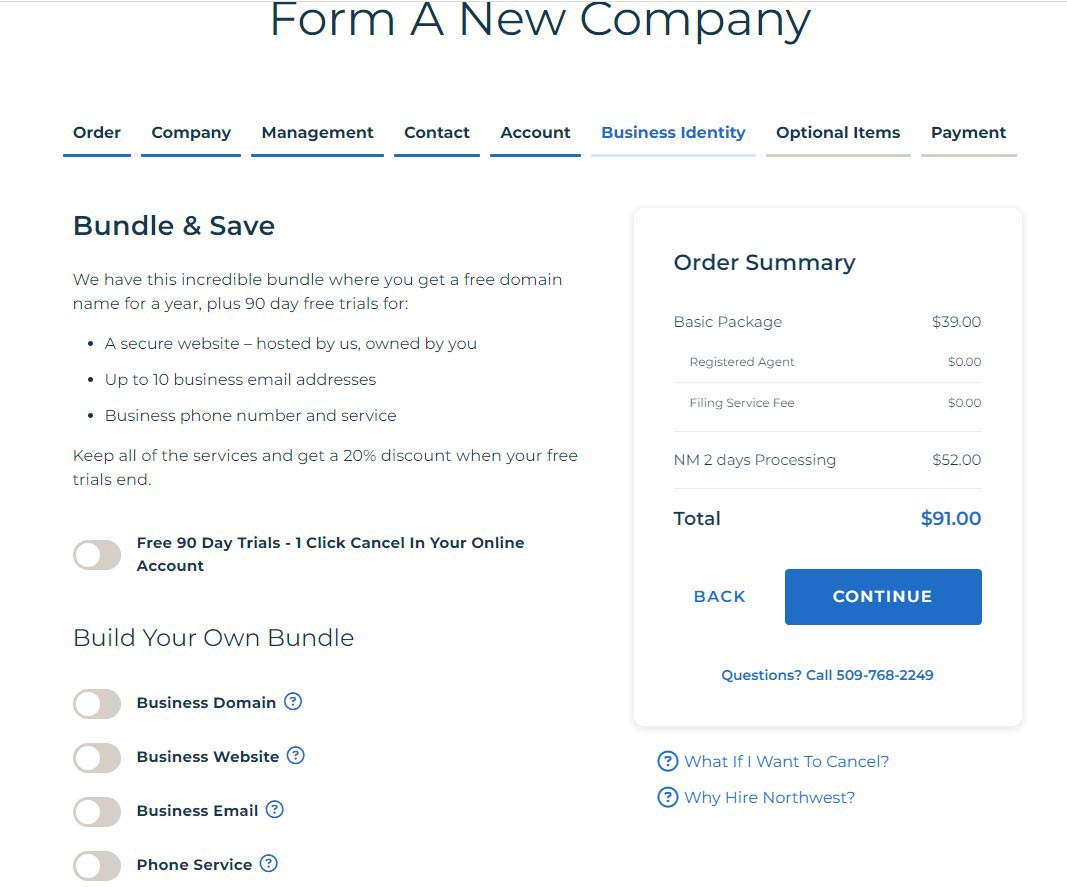

Step 8: Bundle & Save

If you want additional services such as Business Domain, Business Website, Business Email, Phone Service, you can add them to the plan.

Your LLC will be created without these additional services. You can leave it as is and continue.

Click “Continue.”

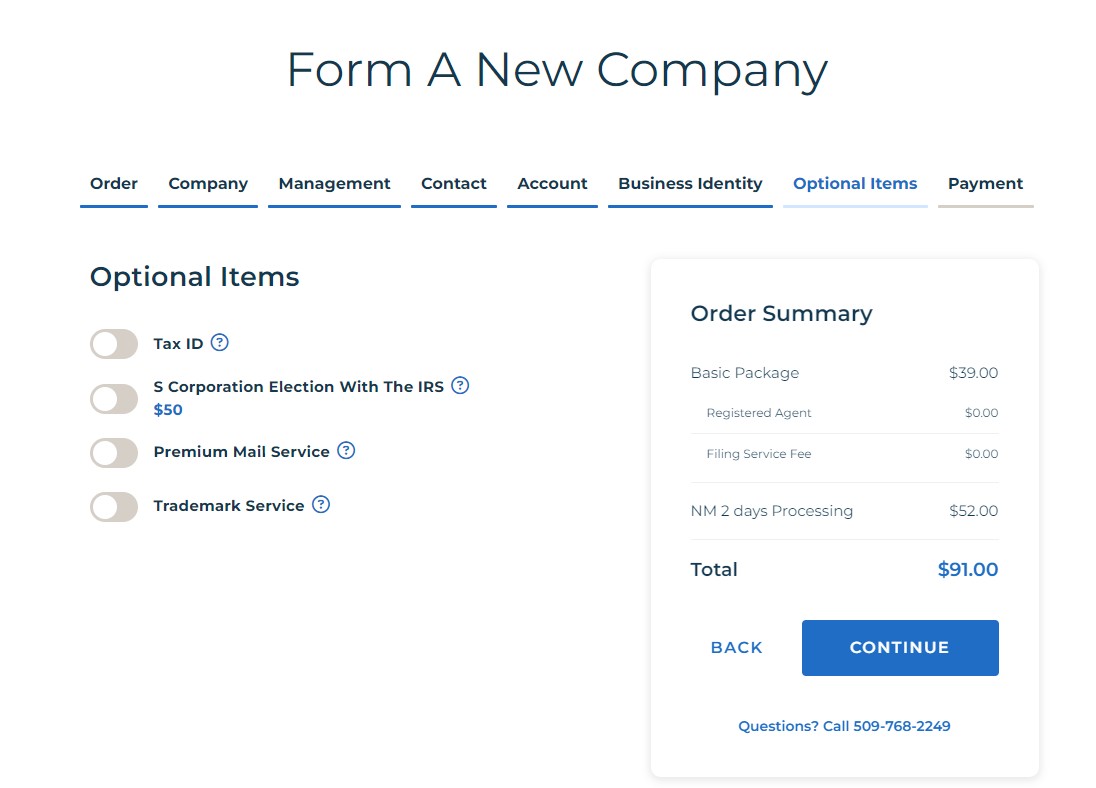

Step 9: Optional Items

You may be offered EIN, compliance services, or other services

EIN prices may be a bit high for non-US citizens. After your LLC is formed, you can also get your EIN number from the IRS for free.

📌If you want, you can add a premium mail forwarding service. This will give you a special suite numbered company address and mailing address. You can add it if you need it, if you do not add it, you will continue to benefit from Northwest's free address service.

Click “Continue.”

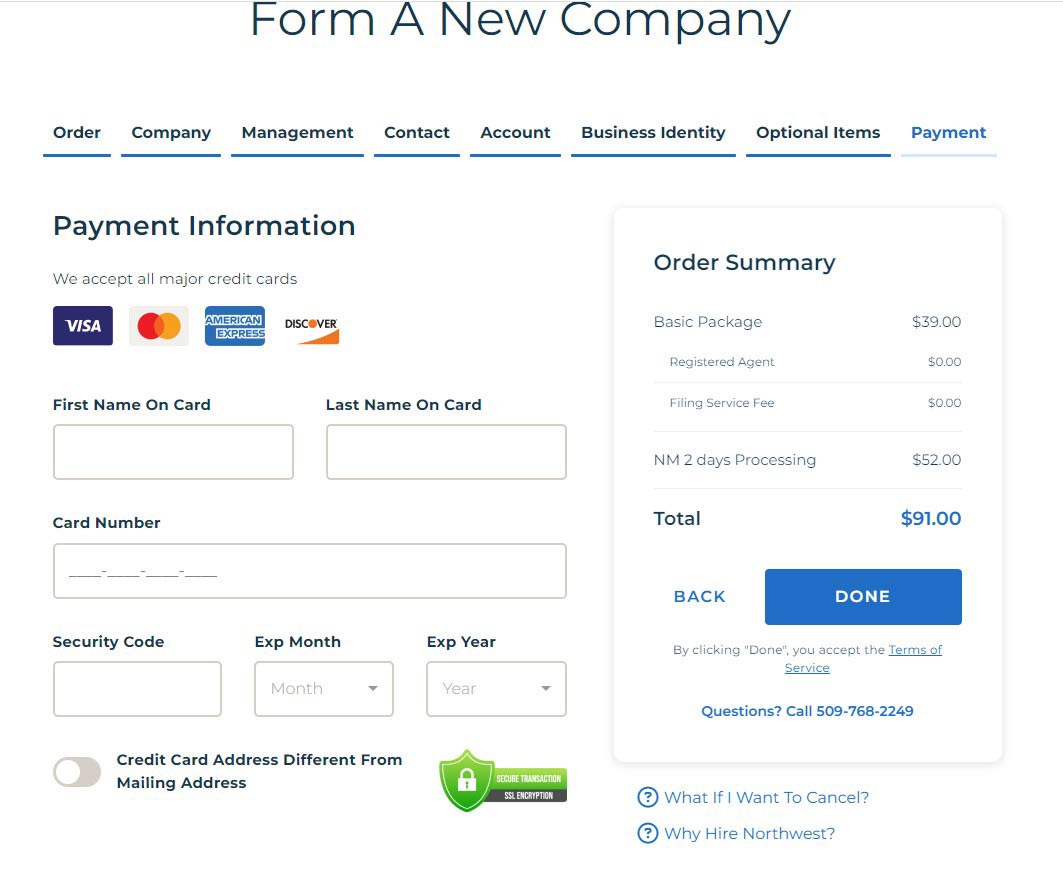

Step 10: Final Review & Payment

Your total cost should be:

$39 for LLC Formation

$52 State Filing Fee

$0 Registered Agent (first year free)

Total: $91

📌After you add your card information and complete the payment, the form will automatically direct you to the Northwest dashboard. You can check the LLC formation status from your dashboard.

Click “DONE” to finalize your LLC formation.

How Long Does It Take to Form an LLC in New Mexico?

Standard processing: 3-4 business days.

Expedited filing: Available for an extra fee.

Once approved, your LLC documents will be available in the Northwest dashboard, where you can download and store them securely.

Your LLC is Approved! What’s Next? Applying for an EIN

Congratulations! 🎉 Your New Mexico LLC has been officially approved, and now you're ready to take the next crucial step: applying for an EIN (Employer Identification Number).

An EIN is required to:

✔️ Open a US business bank account (which is necessary for Stripe).

✔️ Register your LLC for tax purposes with the IRS.

✔️ Complete the business verification process on Stripe.

Applying for an EIN is completely free, and the process can be done via mail or fax using Form SS-4. Once approved, your EIN will allow you to move forward with opening a US bank account and finalizing your Stripe setup.

📌 Next Step: How to Apply for an EIN

To make this process even easier, we’ve created a detailed step-by-step guide on how to apply for an EIN as a non-US resident. 👉 Read the full EIN guide

Once you have your EIN, you’re ready to open a US business bank account let’s move on to that step next! 🚀

Your EIN is Ready! Now It’s Time to Open a US Business Bank Account

Now that you have received your EIN, you are officially ready to open a US business bank account—one of the last key steps before setting up your Stripe account.

A US bank account is mandatory because:

✔️ Stripe requires a US-based account to deposit your payouts.

✔️ Your business bank account must match your LLC details for compliance.

✔️ Without a US account, you won’t be able to withdraw funds from Stripe.

💡 The Best Banking Solution for Non-US Residents: Mercury Bank

For non-residents, the best and easiest solution is Mercury Bank—a US-based digital bank designed for startups and online businesses.

✔️ No physical presence required – You can apply 100% online from anywhere in the world.

✔️ No monthly fees – Mercury has zero account maintenance fees.

✔️ Easy approval process – As long as you have a US LLC and EIN, opening an account is quick and straightforward.

✔️ Works seamlessly with Stripe – Mercury accounts integrate smoothly with Stripe and other payment gateways.

📌 Next Step: How to Open a Mercury Bank Account

To make the process simple, we’ve put together a detailed step-by-step guide on how to open a Mercury business bank account as a non-US resident. 👉 Read the full Mercury Bank Account Guide

Once your US business bank account is approved, you’ll have everything you need to register your Stripe account and start accepting payments worldwide. 🚀

Steps to Create a Stripe Account for Non-US Residents

Now that you have completed all the necessary requirements, you are finally ready to set up your Stripe account and start accepting payments globally.

Before proceeding, make sure you have:

✅ A US-based LLC (registered in New Mexico or another business-friendly state).

✅ An EIN (Employer Identification Number) from the IRS.

✅ A US business bank account (Mercury Bank is the best option).

✅ A US business address (provided by your registered agent).

✅ A verified identity document (passport or national ID).

If you have all of the above, you can now move on to the Stripe registration process, where you’ll submit your business details, verify your identity, and connect your US business bank account to receive payouts.

📌 Next Step: Step-by-Step Stripe Registration Guide

In the next section, we’ll walk you through each step of the Stripe account creation process, ensuring your application is set up correctly for smooth approval. 🚀

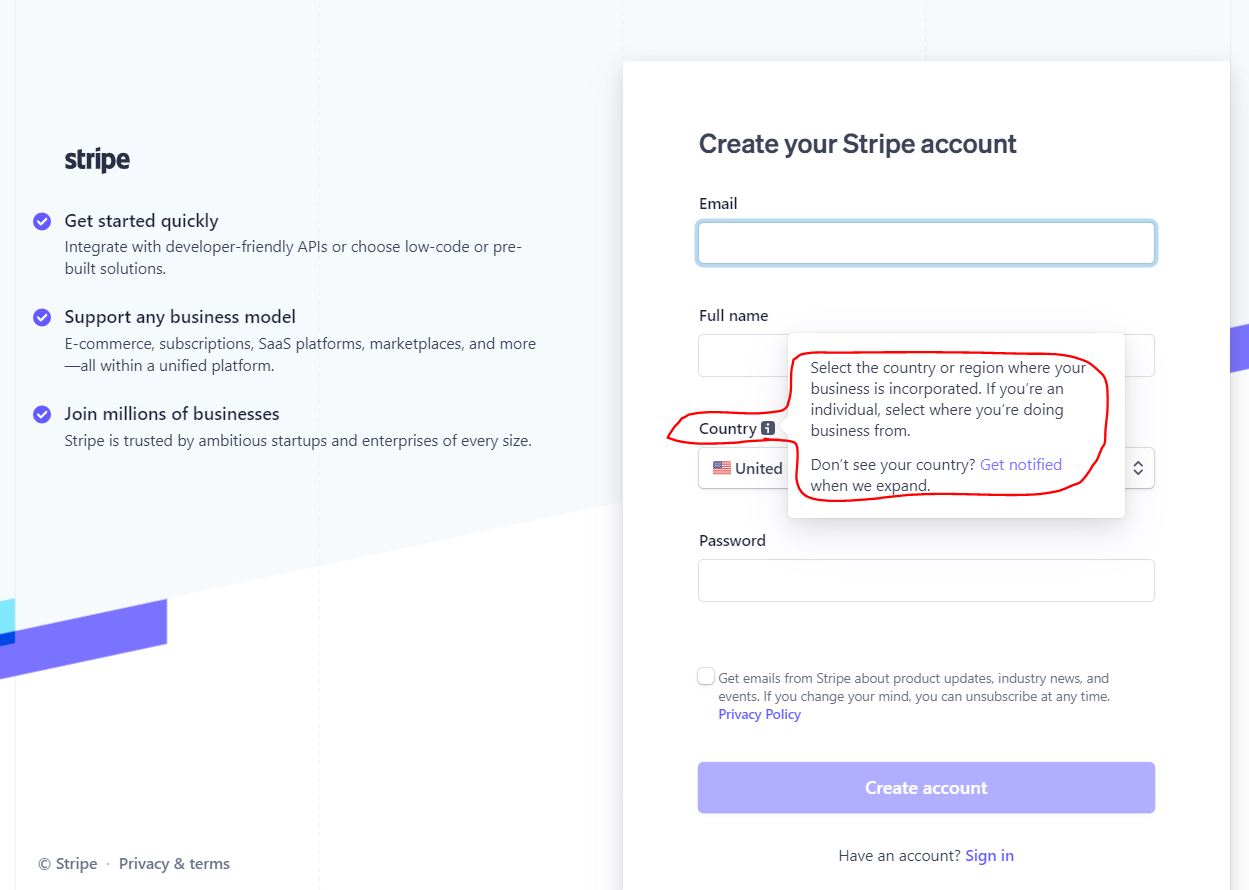

Step 1. https://dashboard.stripe.com/register. Enter your email, and full name, and select the United States as your country. Click on Create Account.

Step 2 : Click on the verification link sent to your email and proceed to the next step.

Step 3 : After the email verification, you will be directed to the Stripe Dashboard. You can start entering your information by clicking on the Activate Payments button on the Dashboard.

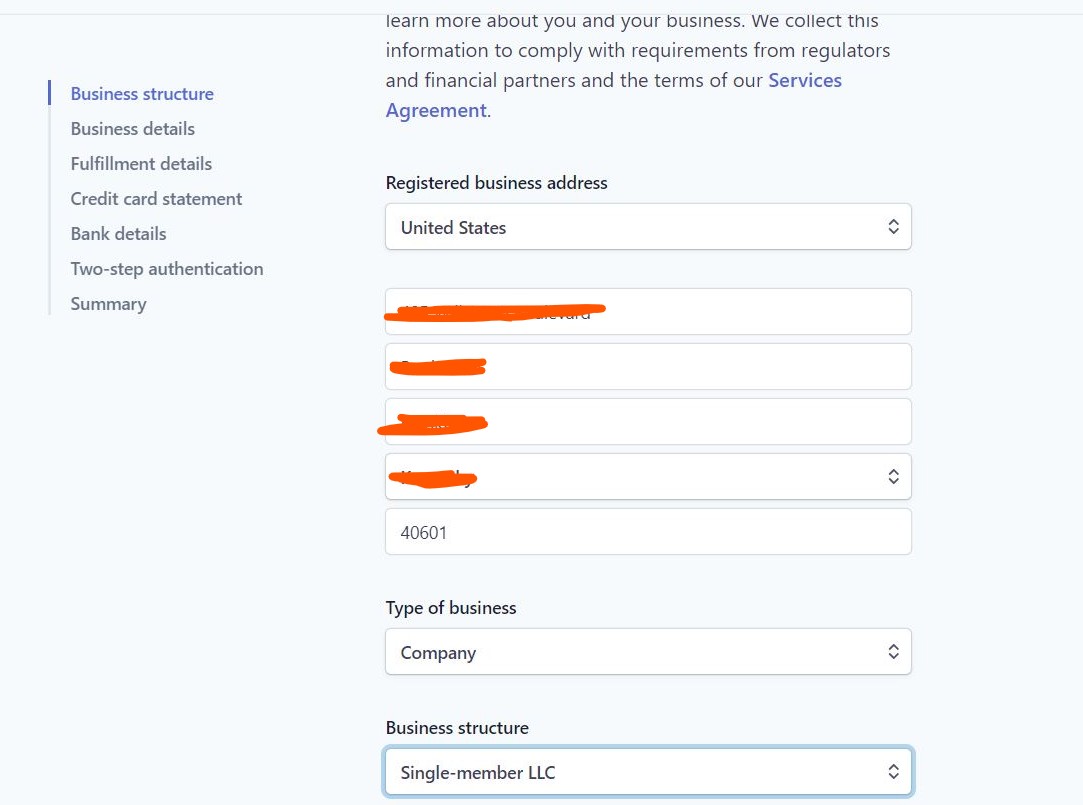

Step 4 : Select the LLC type as : Single member LLC, Registered business address : United States, Enter your company address

Step 5 : In this step, enter your company name, EIN number and company address in the form.

Following this, enter your company name, EIN number and company address in the form. In the Industry option, select the category of your business. For example: E-commerce, Software, etc.

In the Description section, enter a short description of your business

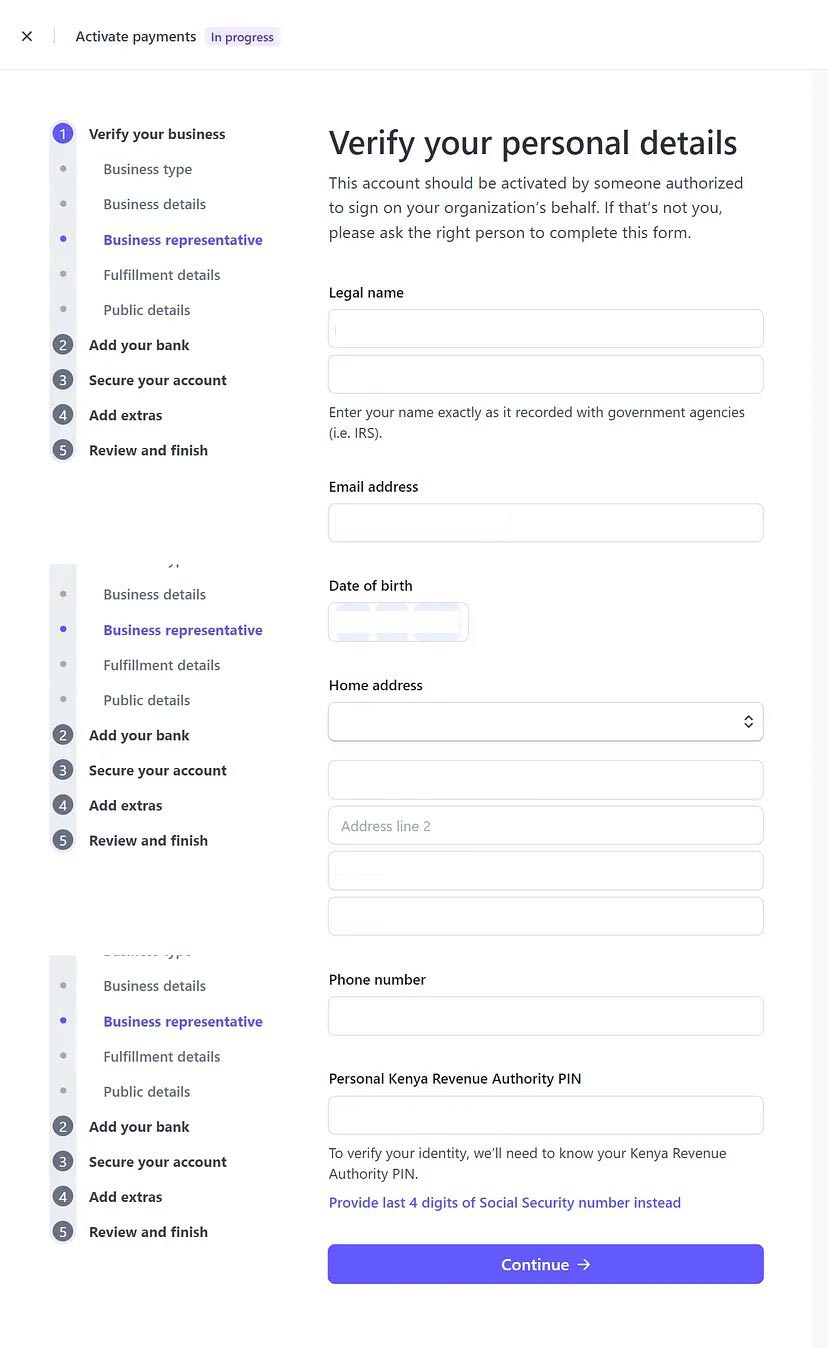

Step 6: Verify Your Personal Information

Enter your real name (as it will be used in your LLC details), email address, and date of birth.

Select your home country, then enter your full address and phone number. Your phone number should be from your home country.

Click "Select" to provide a government-issued ID number, then enter your official identification number from your government-issued ID.

Click "Continue" to proceed. ✅

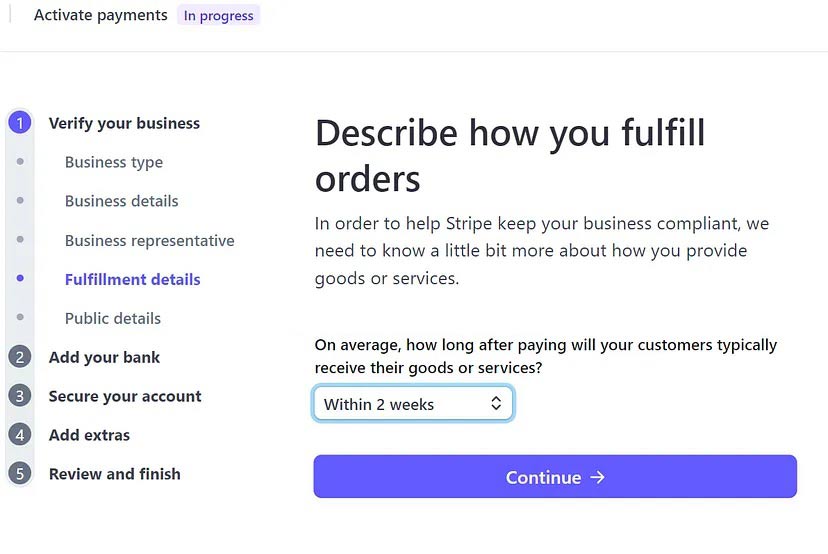

Step 7: Describe How You Fulfill Orders

Explain how you process and fulfill your orders, and select any applicable timeframe.

Our suggestion: It will be to select Same Day or Automatic

Make sure the information you provide is accurate and relevant to your business operations. ✅

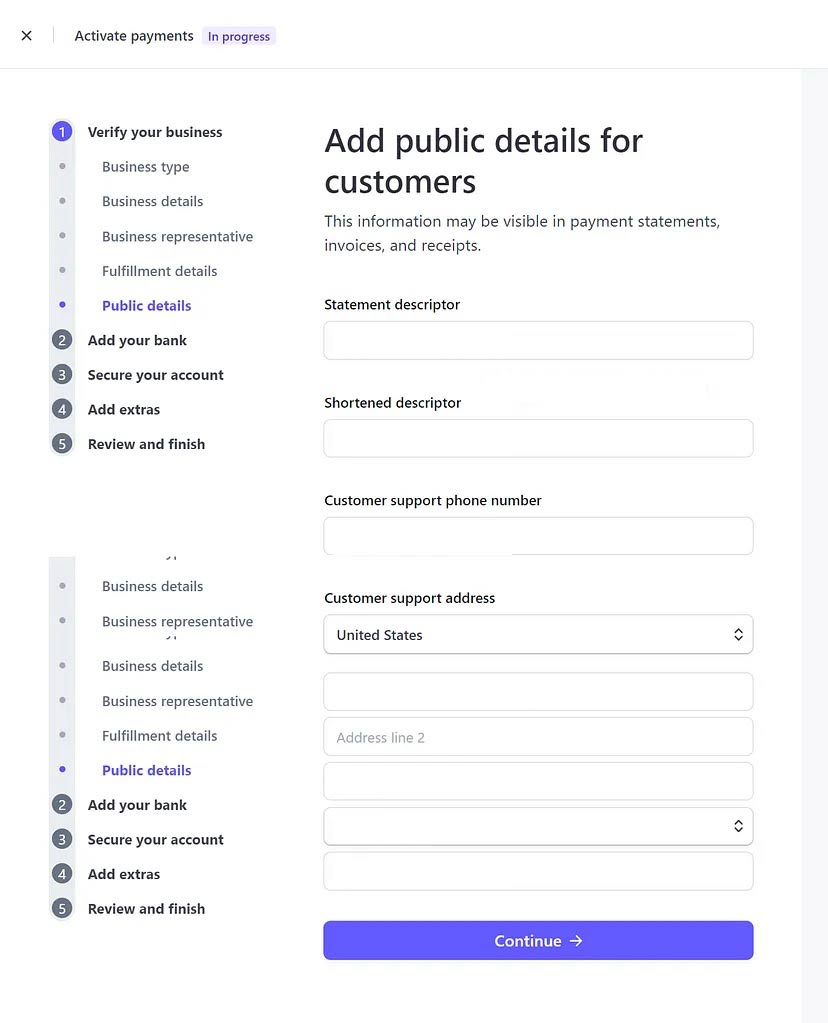

Step 8: Add General Details for Customers

The statement descriptor is the text that appears on your customers' bank statements. It's important to keep this clear and concise so customers can easily recognize the charge.

You can include your business name and legal structure, but for the shortened descriptor, consider using a more compact version. ✅

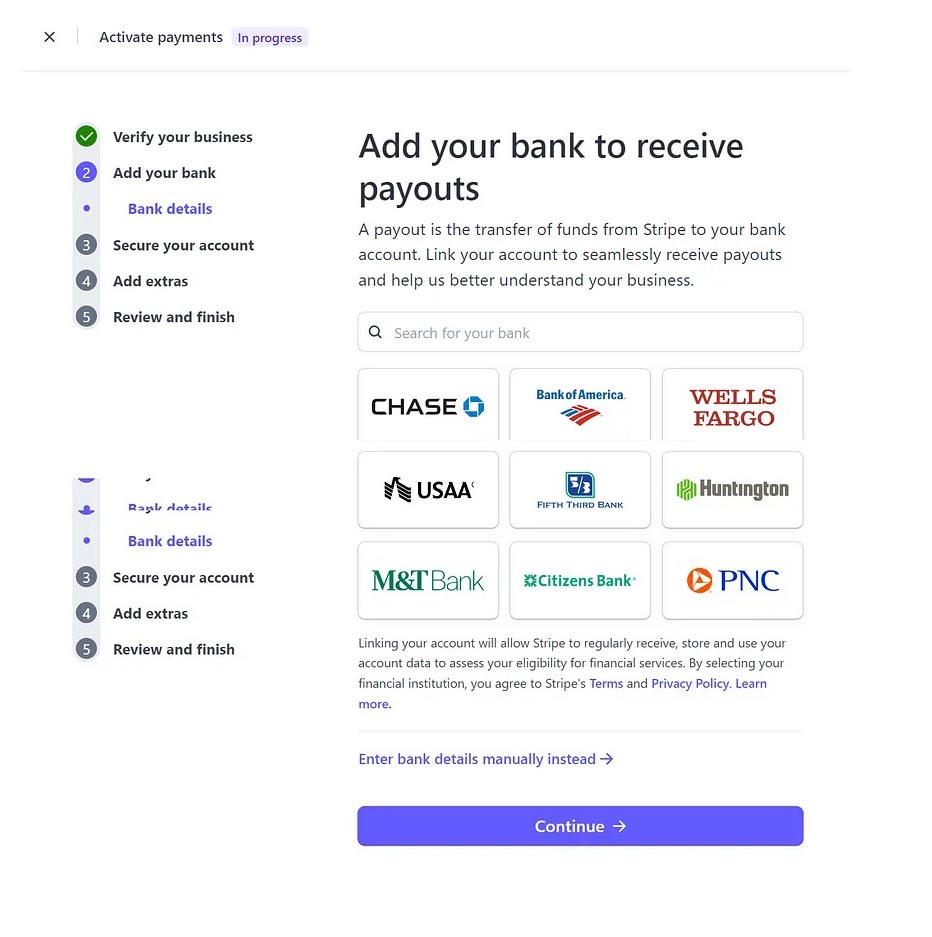

Step 9: Add Your Bank Account

In this step, you need to link your bank account. If your bank is not listed, you must manually enter your banking details.

Since Mercury Bank may not appear in the available options, you will need to enter your account details manually.

⚠️ Note: You can only add a US-based bank account in USD currency. ✅

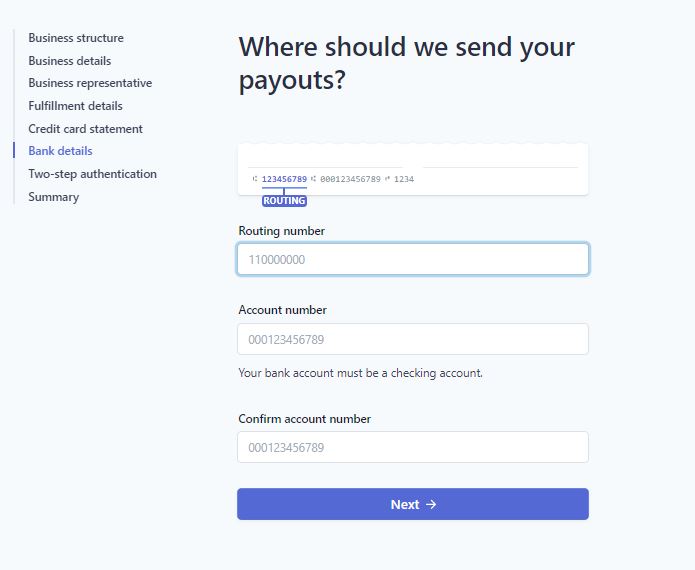

Enter the Account and Routing numbers provided by your bank

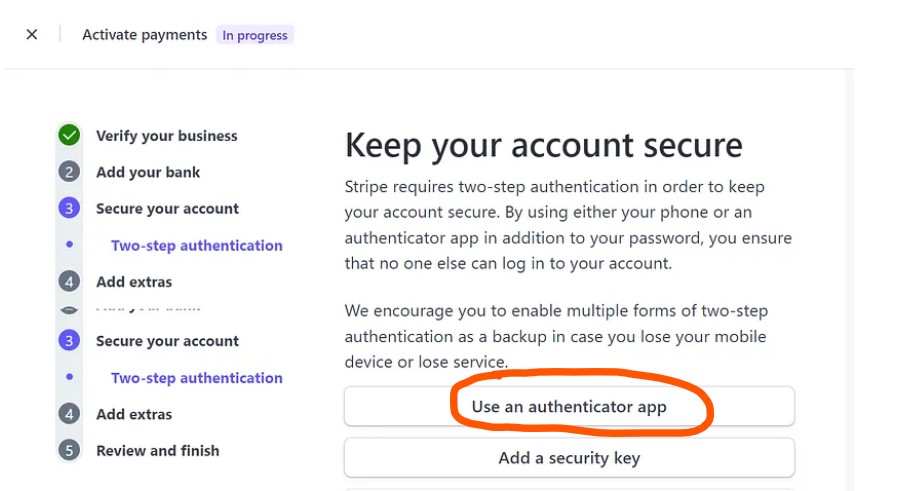

Step 10. Stripe requires you to add 2-factor authentication to your account, so you will need to choose one of the three options. Google Authenticator is usually a good choice.

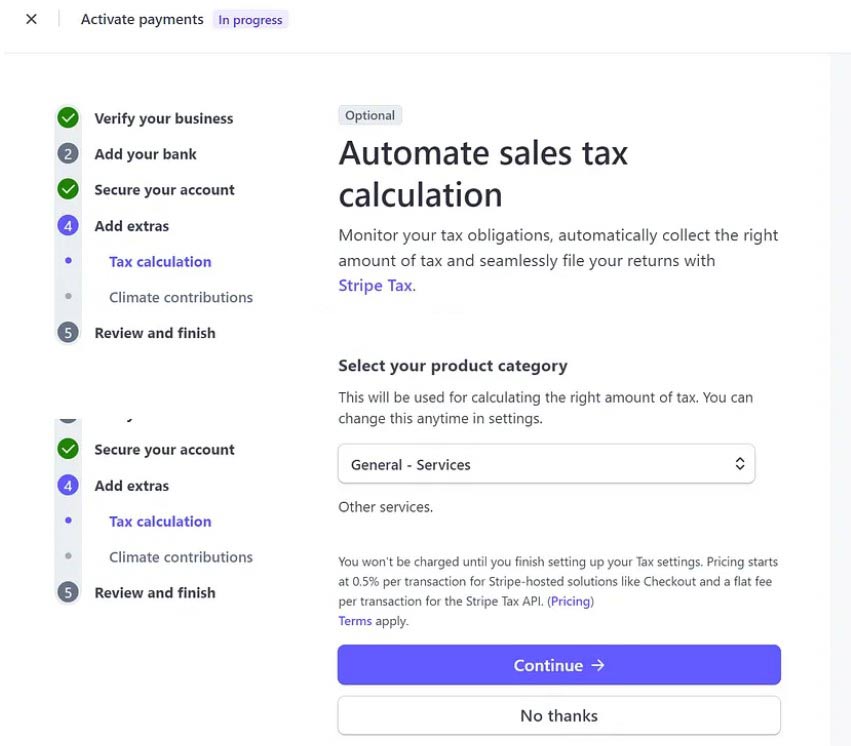

Step 11: It is a plugin to automate sales tax calculations. You can click No Thanks and continue to the next step

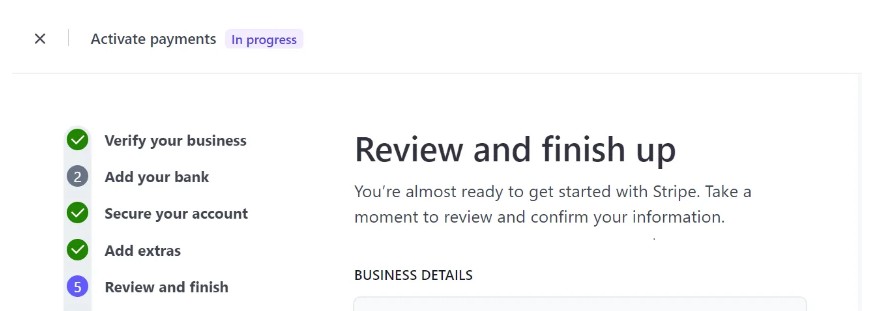

Step 12: Review and Submit

This is the final step—review all the information carefully before completing the process.

Make sure that every section contains accurate details.

If you are absolutely certain that all the information is correct, click "Accept & Submit" to finalize your application. ✅

Final Thoughts: You’re Now Ready to Accept Payments with Stripe!

Congratulations! 🎉 You’ve now completed the ultimate step-by-step guide to creating a US Stripe account as a non-US resident.

If you have entered all the details correctly, your account will now go through a short review process.

Stripe usually automates the verification process, and it is typically completed within a few hours. During this time, regularly check your email and respond promptly to any messages from Stripe.

⚠️ Important: Final Identity Verification

When you log back into your Stripe dashboard, you may be prompted to complete a quick identity verification step.

✔️ This is a simple process—just scan a QR code with your mobile phone, hold your ID close to the camera, and complete a facial scan.

✔️ Simply follow the on-screen instructions, and once this step is done, your Stripe account will be fully activated.

You can now integrate Stripe with your website and start accepting payments worldwide! 🚀✅

If you’ve followed this guide carefully, you should now have a fully functional and verified Stripe account—allowing you to accept payments from customers worldwide with ease.

📌 What’s Next?

If you need additional guidance or have any questions, be sure to check out our other in-depth resources on LLC formation, EIN applications, and business banking at LLCWorld.net.